kentucky transfer tax calculator

These fees are separate from. For example the sale of a 200000 home would require a 200 transfer tax to be paid.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The tax estimator above only includes a single 75 service fee.

. Please note that this is an estimated amount. The median property tax on a 12940000 house is 135870 in the United States. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Kentucky sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The base state sales tax rate in Kentucky is 6. If you are unsure call any local car dealership and ask for the tax rate.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. Find your state below to determine the total cost of your new car including the car tax. Our Kentucky Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Real estate in Kentucky is typically assessed through a mass appraisal. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. Kentucky Real Estate Transfer Taxes.

The median property tax on a 12940000 house is 99638 in Mercer County. 1 of each year. Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Dealership employees are more in tune to tax rates than most government officials. For example the sale of a 200000 home would require a 200 transfer tax to be paid.

It is levied at six percent and shall be paid on every motor vehicle used in. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Kentucky Property Tax Rules.

Transfer tax is collected on the actual consideration paid or to be paid in the deed unless it is a gift. According to Zillow the typical home value in Kentucky is much lower than the typical value of 331533 across the US. Delaware DE Transfer Tax.

Usage Tax A six percent 6 motor vehicle usage tax is levied upon. The median property tax on a 12940000 house is 93168 in Kentucky. The typical home value in Kentucky is 188463 and home values have.

Kentucky has a 6 statewide sales tax rate but also has 226 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top. Property taxes in Kentucky follow a one-year cycle beginning on Jan. Some areas do not have a county or local transfer tax rate.

All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. 142050 Real estate transfer tax -- Collection on recording -- Exemptions. Actual amounts are subject to change based on tax rate changes.

Payment shall be made to the motor vehicle owners County Clerk. This is still below the. If the deed is a gift or indicates nominal consideration the tax is paid on the estimated price the property would bring in an open market.

The transfer tax is imposed upon the grantor The tax is computed at the rate of 50 for each 500. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Kentucky Sales Tax Calculator calculates the sales tax and final price for any Kentucky.

Simply enter the costprice and the sales tax percentage and the KY sales tax calculator will calculate the tax. Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Once you have the tax rate multiply it with the vehicles purchase price. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Kentucky Transfer Tax Calculator Real Estate. Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan.

The State of Delaware transfer tax rate is 250. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including. Kentucky Documentation Fees.

A county clerk cannot register or issue license tags to the owner of any vehicle unless the owner or his agent pays the Motor Vehicle Usage Tax in addition to the transfer registration and license fees. Kentucky Hourly Paycheck Calculator. Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above.

This tax is collected upon the transfer of ownership or when a vehicle is offered for registration for the first time in Kentucky. You can do this on your own or use an online tax calculator. A Deed means any document instrument or writing other than a will and other than a lease or easement regardless of where made executed or.

All rates are per 100. 1 As used in this section unless the context otherwise requires. To avoid delinquent tax it is recommended that the seller pay taxes at the time of transfer.

The KY sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

Find your Kentucky combined state and local tax rate. 2000 x 5 100. If not the seller will be sent a notification by the Kentucky Revenue Cabinet of the tax due.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

Transfer Tax Calculator 2022 For All 50 States

What You Should Know About Contra Costa County Transfer Tax

Transfer Tax In Marin County California Who Pays What

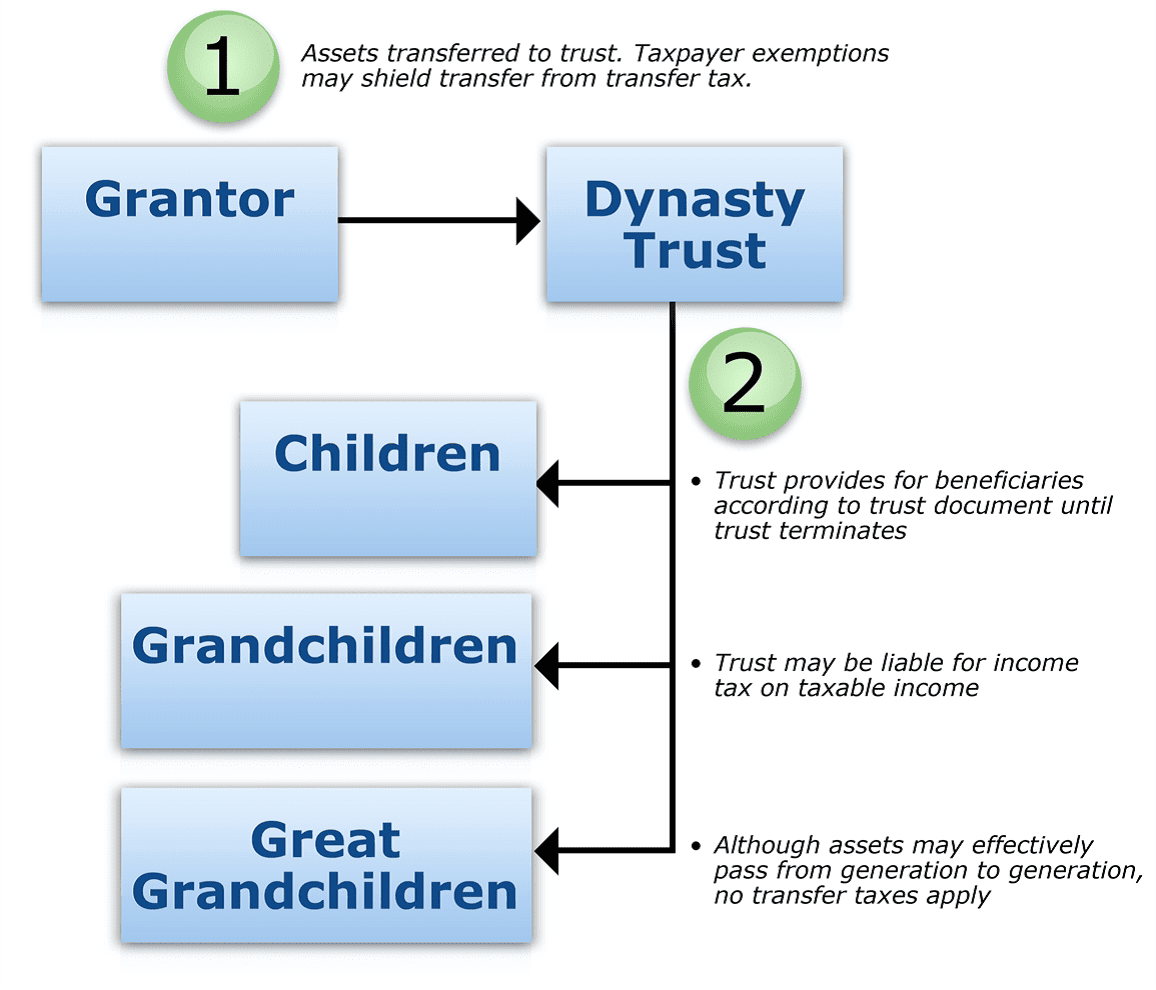

Is Your Legacy In A Dynast Trust Cwm

Montgomery County Md Property Tax Calculator Smartasset

Transfer Tax Alameda County California Who Pays What

Kentucky Real Estate Transfer Taxes An In Depth Guide

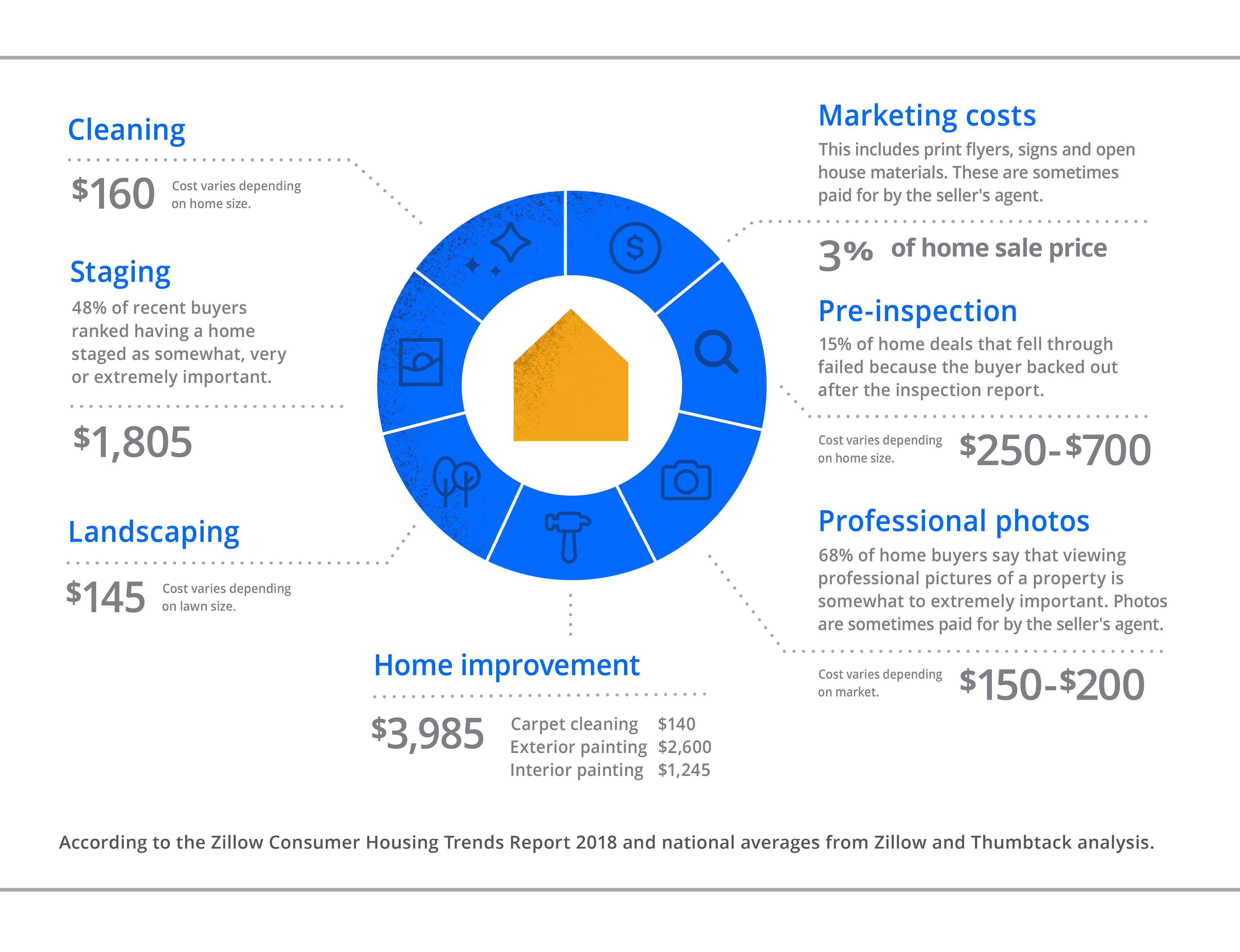

How Much Does It Cost To Sell A House Zillow

Dmv Fees By State Usa Manual Car Registration Calculator

Sales Tax Guide For Online Courses

Tax What Is Tax Taxation In India Tax Calculation

How Much Does It Cost To Sell A House Zillow

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Guide For Online Courses

Transfer Tax In San Luis Obispo County California Who Pays What

Car Tax By State Usa Manual Car Sales Tax Calculator

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)